Alberta’s 2024 Budget Highlights

On February 29, 2024, the Alberta Minister of Finance announced the province’s 2024 budget. This article highlights the most important things you need to know about this budget, broken into 2 sections:

-

Personal Tax Changes

-

Business Tax Changes

Personal tax changes

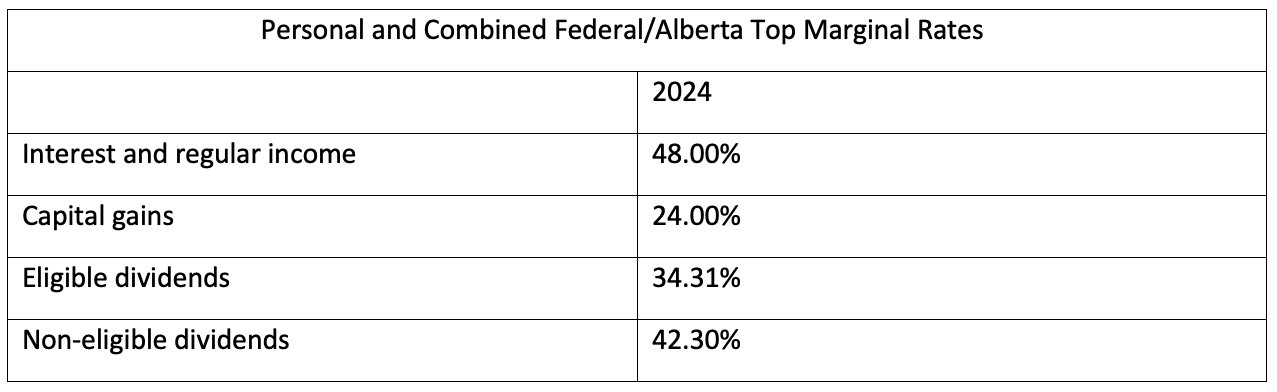

There are no changes to the province’s personal tax rates in Budget 2024.

As a result, Alberta’s personal income tax rate remains as follows:

The budget outlines Alberta’s commitment to fulfill its election promise of introducing a new personal income tax bracket of 8% on the first $60,000 of income. This implementation is projected to occur gradually over the years 2026 and 2027. However, it is contingent upon the province maintaining sufficient fiscal capacity and achieving a balanced budget.

Alberta is Calling Attraction Bonus:

The budget unveils the Alberta is Calling Attraction Bonus, a one-time $5,000 refundable tax credit designed for individuals relocating to Alberta and working in specific occupations after the program’s launch in April 2024. To qualify for the credit, individuals must be employed full-time in one of the designated occupations, file their 2024 taxes in Alberta, and reside in the province for a minimum of 12 months, among other criteria. Alberta plans to release further details regarding the application procedure and additional eligibility requirements in the coming days.

Electric vehicles tax:

The budget unveils a new measure, imposing a $200 yearly tax on electric vehicles, slated to take effect on January 1, 2025. Alberta specifies that this levy, exempting hybrid vehicles, will be collected during vehicle registration and will supplement the current registration fee. Further information regarding this tax will be disclosed by Alberta upon the introduction of legislation to enact this measure in fall 2024.

Education Property Tax:

Education property tax rates remain unchanged in the budget, with mill rates frozen at the following levels:

-

Residential/farmland: $2.56 per $1,000 of equalized assessment

-

Non-residential: $3.76 per $1,000 of equalized assessment

Business tax changes

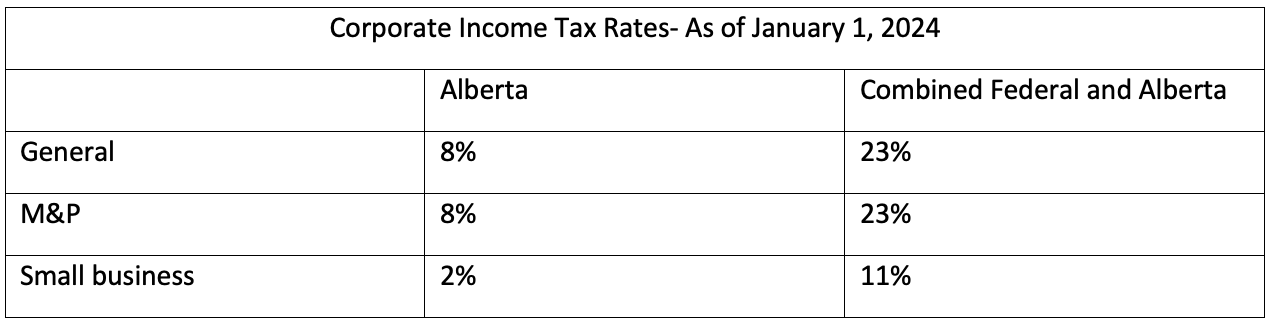

There are no changes to the province’s personal or corporate tax rates in Budget 2024.

As a result, Alberta’s Corporate income tax rate remains as follows:

We can help!

Wondering how this year’s budget will impact your finances or your business? We can help – give us a call today!

Source: https://www.alberta.ca/budget